AI and the American Economy: From Hype to Hard Numbers

Surely you heard the saying “You have to prove your worth.” Thats what AI heard a lot over the past few years, but now the transformation is no longer theoretical-AI is reshaping the economy in measurable, profound ways.

Tired of reading? Don't you worry, we got you!

Remember when economists puzzled over the "Solow Paradox," Nobel laureate Robert Solow's famous observation that "you can see the computer age everywhere but in the productivity statistics." That paradox appears to be dissolving before our eyes. The artificial intelligence revolution is beginning to show up where it matters most: in the economic data.

The Productivity Awakening

The third quarter of 2025 delivered the kind of numbers that make economists sit up and take notice. The Bureau of Labor Statistics reported a stunning 4.9% jump in nonfarm business sector labor productivity, driven by output surging 5.4% while hours worked barely budged at 0.5%. This isn't just a quarterly blip. According to an analysis by the St. Louis Federal Reserve, aggregate labor productivity has been growing at an annualized rate of 2.16% since the introduction of generative AI in late 2022, significantly outpacing the 1.43% average seen between 2015 and 2019.

Workers using generative AI reported saving 5.4% of their work hours, translating to a 1.1% productivity boost for the entire workforce. Perhaps even more telling, St. Louis Fed research found that industries with 1 percentage point higher time savings experienced 2.7 percentage points higher productivity growth relative to their pre-pandemic trend.

This is what economists call a "jobless expansion"-firms generating more output without proportionally increasing labor input. It's the clearest signal yet that AI has moved beyond the hype cycle into becoming a structural driver of economic growth.

The Infrastructure Gold Rush

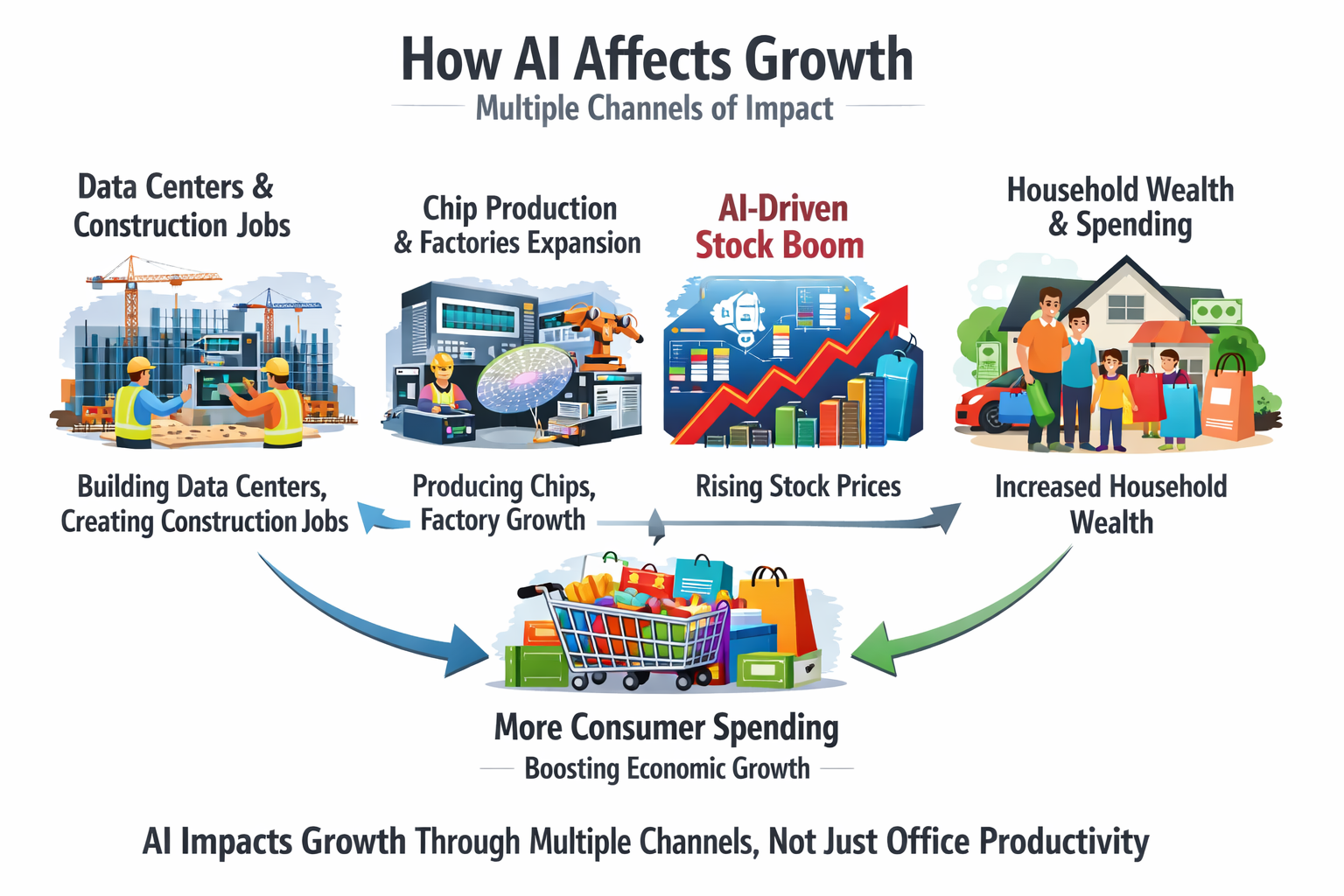

Behind these productivity numbers lies an unprecedented infrastructure investment boom. The current U.S. growth story is fundamentally an AI infrastructure story, with capital expenditures on data centers, advanced chips, and AI software driving GDP growth above its long-term 2% trend.

The scale is staggering. In Q3 2025 alone, tech giants Microsoft, Alphabet, and Meta invested a combined $112.5 billion. In capital projects, Amazon is representing massive year-over-year growth. According to Bloomberg Economics, AI-linked spending contributed roughly 1 percentage point to GDP growth in the first half of 2025. A World Economic Forum analysis suggests that 80% of the increase in final private domestic demand in the first half of 2025 is attributable to data centers and related high-tech spending.

The investment wave extends beyond the tech giants. Bank of America data shows that small-business payments to technology services rose 6.9% year over year in September 2025, with particularly strong growth in the manufacturing and construction sectors. This broadening adoption suggests AI investment has moved well beyond early adopters.

The financial ripple effects are equally impressive. The "AI rally" in equity markets has created an estimated $5 trillion in new wealth, which JPMorgan calculates has fueled approximately $180 billion in additional consumer spending, accounting for nearly one-sixth of the total increase in U.S. consumption over the past year.

From Boardroom Strategy to Desktop Reality

While macro statistics capture the aggregate picture, the real transformation is happening at the individual level. As of August 2025, over 37% of U.S. workers are using generative AI for professional tasks, according to Federal Reserve surveys. That's higher than PC adoption rates were at a comparable point in their diffusion cycle.

The usage patterns reveal important insights. By August 2025, workers were spending 5.7% of their work hours using generative AI, up from 4.1% just nine months earlier. This isn't casual experimentation-it's becoming embedded in workflows. Research from Anthropic suggests that for certain complex tasks, AI can reduce completion time by up to 80%.

The productivity gains are particularly pronounced in knowledge-intensive sectors. Professional and technical services saw a 2.5% increase in total factor productivity, far outpacing more labor-intensive industries. This pattern suggests AI is playing out primarily as a white-collar productivity story, at least in these early stages.

The Shadow of the Dot-Com Boom

The rapid ascent naturally invites comparisons to the late 1990s. Critics point out that 92% of recent growth can be traced back to AI and its ecosystem, a concentration that raises legitimate concerns about a potential "capex bubble" if revenues don't eventually justify the massive infrastructure investments.

The parallels to the dot-com era are undeniable: massive capital inflows, soaring valuations, and transformative claims about technology's impact. But there are crucial differences. Today's AI infrastructure-the data centers, chips, and networks-has immediate, measurable applications. Companies aren't just betting on future possibilities; they're already seeing productivity gains.

The Long View: Projecting to 2030 and Beyond

Looking ahead, projections from the Penn Wharton Budget Model suggest cumulative GDP could see a 3% boost by the 2050s as AI adoption saturates the workforce. Penn Wharton estimates that AI will increase productivity and GDP by 1.5% by 2035, nearly 3% by 2055, and 3.7% by 2075. The boost to annual productivity growth is expected to peak in the early 2030s (reaching 0.2 percentage points in 2032) before gradually moderating.

More conservative estimates from economists at the Dallas Federal Reserve and Goldman Sachs project AI could boost annual productivity growth by 0.3 percentage points over the next decade, still significant, but far from revolutionary. These projections acknowledge substantial uncertainty; we're extrapolating from limited data on AI's initial effects.

The economic implications extend beyond GDP numbers. If productivity gains are sustained, they offer what economists call a "soft landing" for the economy: higher output that caps inflationary pressures and elevates living standards without requiring constant fiscal stimulus. In a preliminary analysis, Penn Wharton estimates that AI could reduce federal deficits by $400 billion over the 10-year budget window from 2026 to 2035.

The Global Context

While the United States leads in AI investment, U.S. private AI investment hit $109.1 billion in 2024, nearly 12 times China's $9.3 billion. The competition is intensifying. According to the Stanford AI Index Report, China saw a 27 percentage-point year-over-year increase in organizational AI use, with Europe following at 23 percentage points. The U.S. maintains more than 40% of global data center capacity, but other regions are closing the gap.

Corporate AI investment worldwide reached $252.3 billion in 2024, with private investment climbing 44.5% year-over-year. The sector has experienced dramatic expansion, with total investment growing more than thirteenfold since 2014.

The Verdict for 2026

The evidence is clear: AI has moved past the "toy" phase. It's no longer confined to demonstrations, research papers, or venture capital pitch decks. The technology is now the steel-and-silicon foundation of modern economic growth, evident in productivity statistics, GDP contributions, and corporate investment patterns.

Questions remain, of course. Will the productivity gains continue as the technology matures? Can the infrastructure investments generate sufficient returns to justify their scale? How will AI reshape employment patterns across different sectors and skill levels? And perhaps most importantly, can we ensure these economic gains translate into broadly shared prosperity?

What we know for certain in early 2026 is that the Solow Paradox is finally being resolved. After decades of waiting for the computer revolution to appear in productivity statistics, we're now watching the AI revolution do precisely that. The numbers don't lie-and they're telling a story of fundamental economic transformation that's only just beginning.