Focus Groups: An In-Depth Exploration

New Coke flopped. The Ford Edsel bombed. Countless "sure-thing" products died on arrival, despite extensive focus group testing. Yet Apple, Obama, and Pfizer credit focus groups for some of their biggest wins. So what gives?

Focus groups are simultaneously the most trusted and most misunderstood tool in market research. Get them right, and they unlock profound insights into human behavior. Get them wrong, and they become expensive exercises in groupthink. This article cuts through the hype to show you exactly when focus groups work, when they fail, and how to use them effectively.

Tired of reading? We got you!

The History

To fully grasp the essence of focus groups, we must trace their origins. The roots of focus groups can be traced to the mid-20th century, specifically to the pioneering efforts of Robert K. Merton, a sociologist and marketer. Merton, perceptive and forward-thinking, discerned the need for a more interactive and insightful approach to market research, one that departed from the conventional surveys and questionnaires.

In 1941, while collaborating with the Office of Radio Research, Merton conducted one of the earliest focus groups. He convened individuals to deliberate on their opinions regarding radio programs, thus marking the birth of a methodology that would eventually find its application across various industries.

The Nuts and Bolts of Focus Groups

What Is a Focus Group?

A focus group is a qualitative research method where a small group of participants discusses a defined topic under the guidance of a moderator. The goal is not to measure how many people think something, but why they think it.

Focus groups are designed to surface perceptions, emotions, language, and reasoning processes. They work best when the research question is exploratory and open-ended.

What a focus group is not:

- It is not a survey

- It does not measure market size

- It does not predict purchase behavior reliably

- Its strength lies in understanding meaning, not frequency.

Methodology

Focus groups typically comprise a small, thoughtfully selected cohort of participants, typically between 6 and 12 individuals. These gatherings are skillfully moderated by a capable mediator who steers the discussion using open-ended questions. The primary objective is to encourage participants to openly share their thoughts, emotions, and experiences towards a specific product, service, or concept. These deliberations are usually documented and transcribed for meticulous analysis.

Recruitment & Sampling

The quality of a focus group depends heavily on who is in the room.

Participants are usually recruited based on:

- Demographics

- Behavior (e.g. recent buyers)

- Experience with a product or category

- Decision-making role (especially in B2B)

Recruitment often uses screening questionnaires to exclude:

- Professional respondents

- People with conflicts of interest

- Participants who dominate discussions

According to ESOMAR, poor recruitment is one of the top three causes of unusable qualitative data.

Typical Focus Group Structure

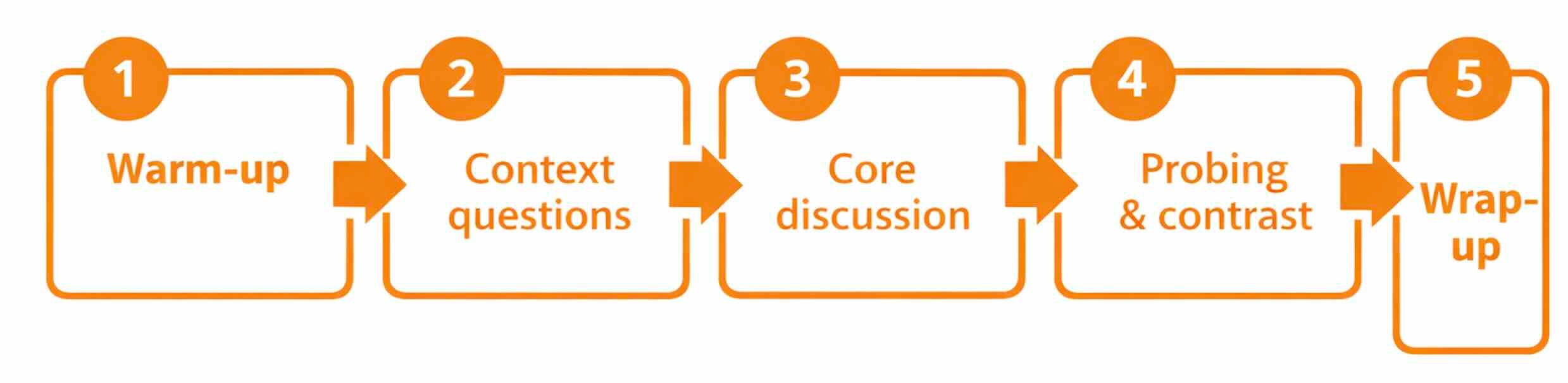

A standard focus group follows a clear structure:

1. Warm-up: Build trust. Reduce anxiety. Encourage speaking.

2. Context questions: Understand habits, attitudes, prior experiences.

3. Core discussion: Deep dive into perceptions, reactions, trade-offs.

4. Probing & contrast: Why? Compared to what? What would change your mind?

5. Wrap-up: Key takeaways in participants' own words.

Sessions usually last 90 to 120 minutes.

When Focus Groups Are the Wrong Tool

Focus groups should not be used when the goal is to:

- Estimate demand

- Set prices

- Predict market share

- Validate final design decisions

- Measure sensitive personal behavior

Harvard Business Review documents multiple cases where companies over-relied on focus groups for predictive decisions, leading to false confidence and poor outcomes.

Data Analysis & Insight Generation

Focus group analysis is not about quotes. It is about patterns.

Typical steps:

- Transcription

- Thematic coding

- Pattern identification

- Insight formulation

- Hypothesis generation

Good insights:

- Explain behavior

- Point to tension or unmet needs

- Are actionable, not descriptive

The Journal of Consumer Research stresses that insights gain reliability when multiple analysts independently code the same data.

Focus Groups in the Digital & AI Times

Today, many focus groups are conducted online.

Benefits:

- Faster recruitment

- Geographic reach

- Lower cost

- Easier recording

AI is increasingly used to:

- Transcribe sessions

- Cluster themes

- Detect emotional cues

- Accelerate synthesis

ESOMAR notes that AI does not replace qualitative judgment, but reduces manual effort and increases consistency.

Ethics & Privacy

Ethical standards are essential in focus group research.

Best practices include:

- Informed consent

- Clear purpose disclosure

- Anonymization

- Secure data storage

In the EU, focus groups must comply with GDPR, especially when dealing with health, political, or biometric data.

Applications

What das Barack Obama, Coca Cola, Apple and Pfizer have in common? They all use focus groups to better understand their customers. Accordingly, applications for focus groups are very versatile. In the following section we will provide some concrete case studies.

Product Development: The Evolution of Apple's iPhone

Apple's rise in the technology industry is due in large part to its skillful use of focus groups. During the development of the groundbreaking iPhone, Apple engaged focus groups to ensure the device's user interface was not only intuitive but also user-friendly. Participants were invited to interact with prototypes, providing real-time feedback on their experiences.

Apple's approach, informed by insights gathered from these focus groups, lead to the creation of a revolutionary product that redefined the smartphone industry. Features like the multi-touch screen and the app ecosystem were meticulously developed based on input from these groups, ultimately setting new industry benchmarks.

Marketing and Advertising: Coca-Cola's New Coke Experiment

Coca-Cola's foray into focus groups is a classic example of the potential, but also the dangers, associated with this research method. In the mid-1980s, Coca-Cola undertook the reformulation of its flagship product, introducing "New Coke."

Before its nationwide launch, focus groups were convened to examine consumer reactions. These groups, however, delivered mixed feedback, with some participants expressing a preference for the new flavor. Placing considerable reliance on this feedback, Coca-Cola introduced New Coke to a highly unfavorable public reception, which required a rapid return to the original formula, now referred to as "Coca-Cola Classic." This example clearly demonstrates that while focus groups offer valuable insights, they may not always accurately predict real-world consumer behavior.

Political Campaigns: Barack Obama's Precision in Messaging

Focus groups have played a vital role in the formulation of political campaign strategies, where the stakes are high, and nuanced messaging is critical. In the 2008 U.S. presidential campaign, Barack Obama's campaign team ran focus groups to gain a deep understanding of voter sentiments, values, and concerns. These groups facilitated the refinement of campaign messaging and enhanced the effectiveness of connecting with a broad spectrum of voters.

For instance, they uncovered that Obama's "Hope and Change" message strongly resonated with younger voters, a demographic crucial to his victory. Insights from focus groups guided the customization of Obama's speeches and campaign materials, forging an emotional connection with the electorate and contributing to his triumph.

Healthcare: Pfizer's Insights into Medications

Pharmaceutical giants like Pfizer have harnessed the capabilities of focus groups to enhance drug development. When crafting new medications, they frequently seek input from focus groups composed of patients, caregivers, and healthcare professionals. These groups offer invaluable insights into medication efficacy, side effects, and the overall patient experience.

Pfizer, for example, employed focus groups during the development of Chantix, a smoking cessation medication. By involving smokers in focus group discussions, Pfizer gained a deep understanding of the challenges individuals face when attempting to quit smoking, which, in turn, led to adjustments in the medication's design and supporting materials.

Advantages of Focus Groups

As you already read above in the examples, focus groups can bring tremendous benefits for an organisation. But there are more which we will investigate further in the following section.

Rich Qualitative Insights

One of the most compelling advantages of employing focus groups in research lies in their capacity to yield rich qualitative data. Focus groups provide a platform for open, unstructured discussions among participants. This format encourages them to articulate their thoughts, emotions, and perceptions in their own words, granting researchers a window into their innermost motivations and beliefs. Qualitative data obtained in this way are often richly textured and nuanced, going beyond the binary "yes" or "no" responses typical of quantitative surveys.

For instance, consider a company developing a new fitness app. A focus group may unveil not only a desire for user-friendly navigation (a quantitative finding) but also a deeper appreciation for the sense of accomplishment upon completing a workout and the social aspect of sharing progress with friends (qualitative insights). These intricate details can profoundly influence product design and marketing strategies, ultimately enhancing the overall user experience.

Customer Intelligence Enrichment

Insights from focus groups serve as a foundational cornerstone in the creation and enrichment of buyer personas and other customer intelligence tools. These gatherings of diverse individuals provide a unique opportunity to delve deep into the thoughts, emotions, and motivations of potential customers. By engaging participants in open and unstructured discussions, focus groups uncover nuanced aspects of consumer behavior and preferences that quantitative data alone cannot reveal. These qualitative insights become the building blocks for crafting detailed and empathetic buyer personas. From understanding pain points to identifying aspirations, focus group insights help businesses develop personas that are not just demographic profiles but vivid representations of real people with distinct needs and desires. In essence, focus groups breathe life into buyer personas, infusing them with the richness of human experience, and enabling businesses to tailor their marketing strategies and product offerings in a way that genuinely resonates with their target audience.

Interaction and Group Dynamics

Focus groups are great for capturing the complicated dynamics that unfold when people interact. By assembling a diverse range of people with different perspectives, focus groups create a microcosm of real-world interactions. Participants not only express their opinions but also respond to each other's statements. This dynamic interaction can unveil shared experiences, conflicts, and even consensus on specific issues.

For example, within a focus group deliberating environmental awareness, participants may commence with differing views on the significance of recycling. Through interaction and debate, they might arrive at a consensus surpassing individual viewpoints, potentially indicating a broader societal trend. Grasping these group dynamics can prove invaluable to organizations aiming to develop products or campaigns that resonate with their target audiences.

Prompt Feedback

Focus groups are characterized by their speed in generating feedback and are the ideal choice for rapid product iterations. In contrast to the weeks required to collect and analyze data from lengthy surveys or individual interviews, focus group sessions can be arranged quickly. This speed makes it an indispensable tool in industries where quick decisions are essential.

Cost-Effective

Cost-effectiveness is another strength of focus groups, especially when compared to one-on-one meetings. In traditional individual interviews, each participant is interviewed separately, requiring multiple sessions to capture diverse perspectives. In contrast, focus groups gather multiple participants in a single session, making them a cost-effective choice for gaining insights from a spectrum of people simultaneously.

Disadvantages and Limitations of Focus Groups

Of course, every coin hast two sides. While focus groups can be extremely powerful and many positive usecases exist out there, there are disadvantages and limitations that needs to be considered.

Groupthink

Groupthink, a psychological phenomenon in which individuals in a group tend to subscribe to the prevailing opinions or point of view, may call into question the integrity of focus group research.

When participants sense that a consensus is forming within the group, they may be reluctant to express dissenting opinions or present alternative viewpoints. This reluctance can create an artificially uniform view that leads to distorted or incomplete results. Groupthink is particularly problematic when addressing sensitive or contentious topics, where participants may fear social judgment or ostracization for expressing dissimilar views.

To mitigate this limitation, adept moderators play a crucial role in fostering an environment that encourages diverse opinions. They employ probing questions and techniques to uncover concealed dissent and ensure that all participants enjoy an equal opportunity to share their thoughts.

Moderator Influence

Moderators wield significant influence over focus group sessions, a double-edged sword that can impact the research process. A skilled moderator can steer discussions, prompting participants to articulate their thoughts and sentiments. However, moderators may introduce bias by guiding conversations or subtly favoring certain responses. This can lead to inaccurate or misleading findings. To address this limitation, moderators should undergo training to minimize their influence and maintain neutrality. Moreover, an impartial party should review session recordings to assess the extent of moderator influence and safeguard the integrity of the data.

Limited Generalization

A primary limitation of focus groups lies in their relatively small sample size, typically encompassing 6 to 12 participants. Insights gathered from a focus group are specific to the participants involved and may not accurately represent the diversity of opinions and experiences prevalent in the broader population. Therefore, conclusions drawn from focus group data should be approached with caution and not presumed to hold universal applicability - see Coca Cola example above.

To counter act, researchers often complement focus group findings with data from other research methods, such as surveys or interviews, to attain a more comprehensive understanding. In addition, careful selection of participants is paramount to ensure that the group is as accurate a representation as possible of the relevant demographic or target group.

Complexity in Data Analysis

Analyzing qualitative data derived from focus groups can prove intricate and time-consuming.

Qualitative data, by its nature, tends to be voluminous and nuanced. Transcribing and analyzing hours of focus group discussions demands significant resources. Moreover, the interpretation of qualitative data is subjective and can vary among analysts, introducing the potential for bias.

To navigate this limitation, researchers frequently employ specialized software designed for qualitative data analysis, streamlining the process. Furthermore, the involvement of multiple analysts and the implementation of member checks, where participants review and validate findings, can enhance the reliability and objectivity of the analysis. Especially the development in AI helps tremendously. Trained AI models can analyse qualitative data much faster and more efficient than traditional methods. Even the supreme discipline of psychographic segmentation can now be automated by AI.

Enough reading? We got you!

OCEAN Personality Analysis: The Missing Dimension in Focus Groups

Here's the biggest problem with traditional focus groups: two participants with identical demographics can have radically different personalities, and personality determines everything from how people process information to whether they speak up or stay silent. A group dominated by extraverts and highly agreeable participants produces false consensus. A group lacking critical thinkers misses fatal flaws. Without accounting for personality, focus groups become expensive exercises in sampling whoever showed up rather than understanding your actual market.

OCEAN personality trait analysis-also known as the Big Five-solves this. The framework measures five fundamental dimensions: Openness (novelty-seeking vs. tradition), Conscientiousness (disciplined vs. spontaneous), Extraversion (outgoing vs. reserved), Agreeableness (cooperative vs. critical), and Neuroticism (anxious vs. calm). These traits predict how participants engage in discussions, what concerns they raise, and which consumer segments they represent.

Leading research organizations now screen participants for OCEAN traits during recruitment, ensuring each focus group contains balanced personality diversity. Moderators receive personality profiles to inform facilitation, creating space for introverts, probing beyond agreeableness, and contextualizing concerns driven by neuroticism. Post-session analysis layers personality data onto findings, revealing critical patterns: enthusiasm among high-openness participants indicates early-adopter appeal but not mainstream viability; concerns among high-neuroticism individuals highlight barriers that broader audiences will encounter.

OCEAN-informed focus groups produce consistent, reliable insights because personality variables are controlled. Analysis reveals psychographic segments invisible to demographic research, such as the finding that luxury consumers split between those seeking bold differentiation (high openness, low agreeableness) and those seeking timeless craftsmanship (high conscientiousness, high agreeableness). AI-powered tools now make personality assessment fast and affordable, automatically analyzing traits from screening responses and tagging focus group comments by speaker personality.

Organizations that integrate OCEAN gain crucial advantages: more reliable insights, less prone to sampling bias, better prediction of market reception across personality segments, enhanced ability to identify and mitigate groupthink, and a foundation for building sophisticated psychographic customer models. In an era where everyone has access to focus groups, competitive advantage goes to those who understand them at the deepest psychological level-not just what consumers say, but who is saying it and what that means for their broader market.

Key Facts & Sources

To provide a comprehensive understanding of focus groups in the modern research landscape, here are some critical data points and reliable sources:

Usage & Market

Qualitative research accounts for approximately 16% of global market research spend. This significant proportion underscores the continued relevance and value that organizations place on understanding the deeper, more nuanced aspects of consumer behavior that focus groups provide.

Costs & Timeline

The typical cost per focus group in the EU and US ranges from €5,000 to €15,000, depending on factors such as participant recruitment complexity, location, moderator expertise, and the depth of analysis required. The end-to-end timeline for conducting a focus group study typically spans 4 to 8 weeks, from initial planning and recruitment through to final reporting.

Validity & Limitations

Despite extensive prior research, products fail in 40-90% of cases. This sobering statistic highlights that while research methods like focus groups provide valuable insights, they are not infallible predictors of market success. However, combining qualitative and quantitative methods significantly improves decision quality, suggesting that a mixed-methods approach offers the most robust foundation for strategic decisions.

Methodological Risks

Social desirability bias increases in group settings, where participants may tailor their responses to align with perceived social norms or to present themselves favorably. Additionally, moderator bias is one of the most cited qualitative risks, as the moderator's behavior, questions, and reactions can inadvertently influence participant responses and group dynamics.

Real World Examples

Last but not least we would like to give some more real world examples on how organisations use focus groups.

The Starbucks Experience

Starbucks has earned global acclaim not only for its coffee but also for the distinct in-store experience it offers. A significant part of the company's success is attributed to its strategic utilization of focus groups.

Ambiance and Store Layout: Starbucks' signature ambiance, characterized by its cozy, rustic, and inviting designs, owes its conception to input from focus groups. Participants were invited to share their visions of an ideal coffee shop atmosphere, which heavily influenced the brand's store layouts. Elements such as music, lighting, and furniture choices were all crafted based on insights gleaned from these discussions.

Menu Development: Starbucks constantly evolves its menu offerings, and focus groups play a pital ivotal role in this process. A prime example is the creation of the beloved Pumpkin Spice Latte, a seasonal favorite. Its inception was directly shaped by focus group feedback, driven by participants' enthusiasm for fall flavors and spices.

Beverage Names: Starbucks' unique menu vocabulary, featuring sizes like Tall, Grande, and Venti, was also born from focus group deliberations. These discussions ensured that the terminology resonated with customers, contributing to the distinctive café culture that Starbucks has cultivated.

Ford's Consumer-Centric Approach

In the competitive automobile industry, Ford has distinguished itself by embracing the benefits of focus groups in the following ways:

Ford Focus Success: The Ford Focus, a compact car introduced in the late 1990s, owes a significant portion of its success to insights gathered through focus groups. Ford engaged consumers in conversations about their preferences for a compact car, covering aspects such as size, fuel efficiency, and styling. These valuable insights shaped the design of the Ford Focus, rapidly making it a hit due to its practicality and affordability.

Safety Features: Safety is a paramount concern for automobile manufacturers, and Ford is no exception. Focus groups have been instrumental in assessing and refining safety features in Ford vehicles. For instance, participants provided feedback on technologies such as lane departure warning systems and adaptive cruise control, aiding Ford in optimizing these features to align with consumer expectations for safety and convenience.

Procter & Gamble's Product Innovation

Procter & Gamble (P&G), a titan in the consumer goods industry, relies extensively on focus groups to drive innovation in its products:

Diaper Development: When creating Pampers diapers, P&G turned to focus groups to gain insights into parents' needs and concerns regarding baby diapers. The feedback gathered guided the development of diapers that excelled in absorbency, comfort, and user-friendliness, eventually claiming a dominant position in the market.

Cosmetic Products: P&G's beauty brands, such as Olay and Pantene, routinely engage focus groups to gather feedback on new skincare and haircare products. Participants' input shapes P&G's formulations, packaging designs, and marketing messages to align with consumers' desires and expectations.

Final Remarks

Focus groups are more than just a research method; they're a window into what people actually think and feel. Even as the market shifts, sitting down and listening to your audience remains one of the best ways to build things people actually love. If you want to stop guessing and start knowing, it's time to start the conversation.